My entire Virtual Assistant business was borne from the desire to save money. I didn’t want to work all week to spend all of my earnings on childcare!

So it will come as no surprise to you that I have maintained my money savvy approach! If you follow me on social media, you will already know about my love of free coffee treats and cashback sites. For ease of use, I am putting it all into this blog post so that you have a one stop shop when it comes to my tips saving money, either for your own freelance business or your everyday life.

Free coffee

First things first, I said free coffee so I can’t keep you waiting on that promise can I!! To take things back even further, I am actually saving on hotdesking, petrol and time prior to getting the free coffee! I am talking about those days where you just need to get out of the house to work. I got into the habit of paying for a hot desk at a local serviced office place. It was £12 for the day (which has now increased) and I loved it, but £12 plus the cost and time of a 15 minute drive each way soon adds up over the course of a month. Instead I swapped it out for a couple of hours at my local Costa – it’s five minutes away and costs me just a one-shot oat milk latte.

But hang on – I said free drink didn’t I! Well, grab yourself the Costa app and collect a ‘bean’ or points for each drink purchased and you will soon find yourself with enough for a freebie. They also stick extra treats in there like a drink for £2 or like I used today, 10% off a drink.

You can EVEN earn 9% cashback at Costa with a different app, which I will come to a bit further on!

Save on business purchases online

If you shop online for anything, if you’re not checking Topcashback first, then where have you been?!

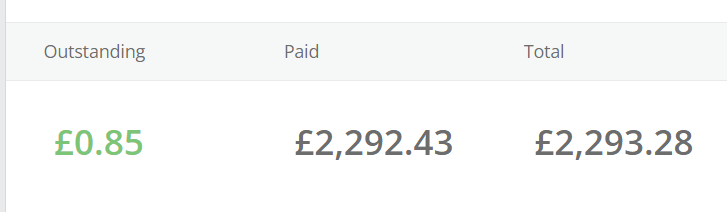

I have made over £2000 in the decade I have been using it. A long time, yes, but that is entirely free money so it’s an absolute win-win.

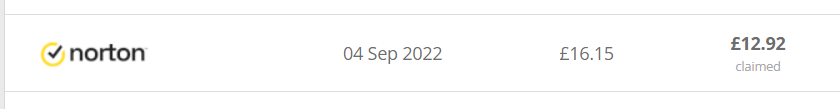

One of my best ever scores for my business was Norton Antivirus. The package was around the £20 mark as a new customer, which earned me £12.92 cashback! This made the package just over £7 for 12 months!!

Sprive for overpaying the mortgage

I came across Sprive a couple of months ago and whilst I am a newbie to the app, I am absolutely loving it so far!

It scans my mortgage and calculates how much money I can afford to save each month and put towards an overpayment, which my mortgage account allows up to a certain limit each year.

But remember I mentioned cashback on Costa? This is where Sprive gets really interesting!

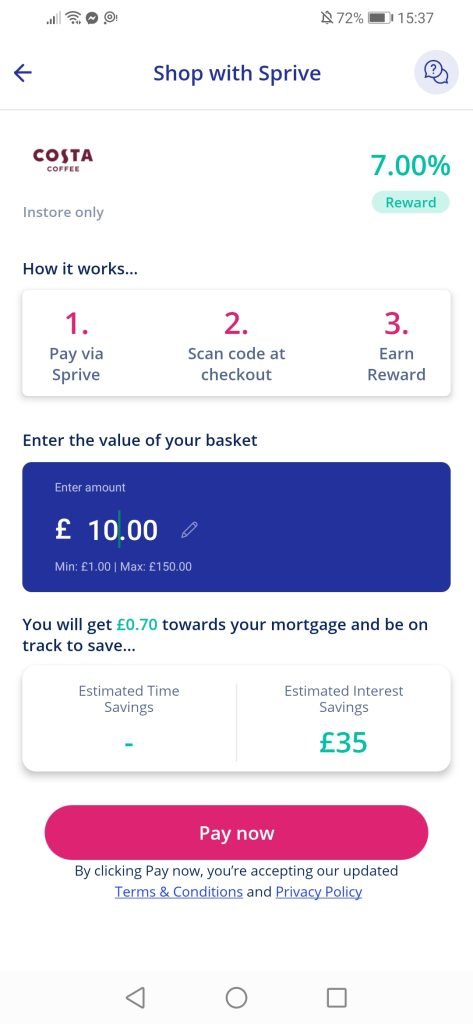

There is a rewards section on the app, which has loads of retailers signed up. You choose your retailer, choose how much you want to load to an online giftcard and make your purchase. And Costa is on there!

Every so often, I will purchase a £10 giftcard for Costa, get my 7% cashback (so 70p towards my mortgage in this case). When in Costa, I scan my app to collect my loyalty beans and then use my pre-purchased gift card to pay.

Clarks is on there, so I will be using it to buy my daughter’s school shoes, and big names like Primark, Asda and Morrisons. If you are shopping somewhere anyway, then it makes sense to earn yourself a bit off the mortgage!

Ensure that you seek appropriate financial advice regarding overpayment of your mortgage before proceeding with this app.

Free/cheap food for lunch

The cost of food is insane right now, so to save money where I can I will check three cashback apps before going to a supermarket to see if I can pick up any super-cheap offers or even better, sometime a freebie!

Today on a trip to Sainsburys and armed with Shopmium, I struck gold with these two Bol meal pots. They were £3 each but there was an offer to try them for £1 each, so I made my purchase, uploaded my receipt and will get £4 cashback.

Save money by paying annually instead of monthly for services for your Virtual Assistant businesses

Whilst paying monthly for services definitely makes things easier to budget for, paying in a lump sum whether it be annually or for a lifetime service, often works out cheaper.

Both the services I use for graphic design and SEO have cheaper options when paying for the longer term, so it’s worth considering if you are able to make those one-off payments instead of spreading the cost.

Search for discounts with your business purchases wherever possible

Whatever you are purchasing, search for discount codes and cashback offers before committing to buy.

If you are yet to purchase Professional Indemnity Insurance, then I can help!

Sign up using this link to receive up to 10% discount on a new policy with PolicyBee, or mention JET Virtual Assistant if you call.

Get savvy with your savings

Whether it’s putting money aside each month for your tax return payments, or saving for the future in a pension or other investments, make sure you are getting the best return on your money by doing your research. Get professional advice if necessary.

I am a huge fan of Martin Lewis, the Money-Saving Expert and off the back of all his advice on pensions earlier in the year, I did my research and opened an investment account with Wealthify.

In conclusion

I hope you have found the above read useful and that it will help you save money in your Virtual Assistant business. If nothing else, I hope it gets you into the habit of thinking and taking your time before a purchase to see if you are getting the best deal for something.

I must point out that some of the links in this article are referral/affiliate links which means I may receive a small reward if you choose to sign-up. This is at no extra cost to you. In fact, you may also receive a small reward too! At the time of writing for example, Shopmium is offering a free bag of Cadburys buttons (July 2023), but as these offers will change I have not detailed them in the text.

Disclaimer:

We shall not be responsible for any losses and/or damages due to the usage of the information on our website.

Although we are invested in making sure the contents provided on our website are accurate and provide valuable information, nothing contained on this website should be understood as a recommendation or a professional financial advice, and should you wish to make a decision based on any material which you’ve come across on our website, we expressly recommend you should consult with a financial professional to address any inquiry or particular information you may have.